Real Estate Investment Manager

Creating value across cycles since 2006.

Invest with us

Team

6

Investment professionalsAmount Invested

+€640Mn

5 investment vehicles, 2 operating companiesPerformance

+20% IRR

Proven performance in living asset classExperience

+15 years

experience in the real estate marketOur Investment Philosophy

Capital Preservation

Active Asset Management

Sustainable Investments

Benefits of Our Philosophy

- Delivering Consistent Returns: Our investment philosophy aims to deliver consistent and attractive returns over the long term, aligning with our clients’ financial objectives.

- Mitigating Risk: By adhering to our core principles, we strive to minimize downside risk and preserve capital, providing our clients with a sense of security and peace of mind.

- Building Wealth: Our philosophy focuses on generating wealth through strategic real estate investments, capitalizing on market opportunities and optimizing asset performance.

Our Investment Process

Step 1: Research and Analysis

At Amira, we begin by conducting thorough research and analysis. Our team of experts leverages comprehensive market research, performs meticulous due diligence, and assesses risks to identify the most promising investment opportunities. We believe in data-driven decision-making to maximize returns and minimize risks.

Step 2: Strategy Development

Once our research is complete, we develop a tailored investment strategy for each client. We take into account their specific goals, risk tolerance, and investment horizon. Our strategy involves identifying target markets and asset classes that align with our clients' objectives. With a meticulous approach, we craft investment plans that maximize returns while managing risk effectively. Our commitment to strategic development ensures that every investment aligns with our clients' unique financial goals.

Step 3: Acquisition and Due Diligence

At Amira, we follow a rigorous acquisition and due diligence process. We carefully evaluate potential properties, assessing their financial viability and growth potential. Our team conducts thorough financial analysis, property inspections, and legal due diligence to mitigate risks. We only pursue investments that meet our stringent criteria and align with our clients' objectives. By meticulously vetting every opportunity, we strive to provide our clients with high-quality assets that deliver long-term value.

Step 4: Asset development

Asset development encompasses both greenfield and brownfield projects, with the primary objective being to generate value by strategically repositioning the asset. This involves a meticulous process of revitalizing and optimizing the asset's use and potential, ensuring it aligns with market demands and trends. Through this approach, the aim is to enhance its long-term performance, thereby maximizing returns on investment and contributing positively to the broader real estate landscape.

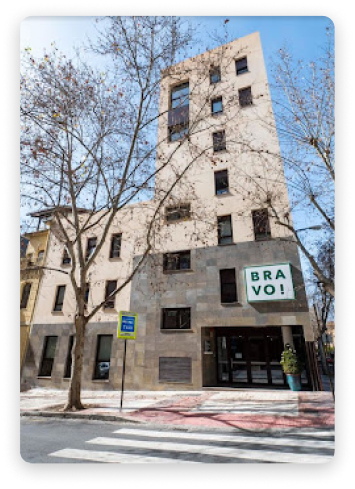

Our Assets